When a relationship ends, having a clear picture of your financial future can make all the difference. In the same vein, the way your property and assets are divided can shape your financial wellbeing in the years to come. That’s why it’s important to have experienced, specialist advice from expert property settlement lawyers on your side.

At Watts McCray, we have exceptional knowledge in asset division and years of experience in property settlement matters. With a keen eye to your individual circumstances, we will advise you on the best course of action, every step of the way.

What is property settlement?

Once you and your partner decide to separate, you’ll need to consider the process of dividing your property and assets. Should you end things amicably, this process can be straightforward and free of complication. The ideal scenario is that you and your ex-partner work together to resolve this yourselves, or through mediation. Once there is an agreement, however it is reached, that should be properly documented to give you certainty for the future.

However, if communication between you and your ex-partner fails and you are unable to reach an agreement, you should reach out to expert family lawyers. We can help you to move your property settlement along with the best results for your situation.

Who is entitled to property settlement

In New South Wales – and indeed across Australia – both married and de facto partners can be entitled to a property settlement under Family Law. In fact, under Australian Family Law, if you’re living together with someone as part of a couple, then depending on the circumstances and the length of time, your rights will be exactly the same as those of a married couple. This includes same-sex couples – whether married or de facto.

Even if you haven’t contributed financially to the relationship property, or your name isn’t on the relationship assets – like the cars or the home – there can still be a property settlement and you should consider your entitlement to a division of the assets.

Some time limits do apply in Sydney, and across New South Wales and Australia:

- For married couples – within 12 months of a divorce order becoming final

- For de facto couples – within two years of separation

What’s included in a property settlement?

A property settlement looks at the net asset pool. The net asset pool includes everything you and your former partner own or owe – whether on your own or together. All of these items are brought together and then considerations about past and future circumstances applied to determine how they should be divided.

What types of property are included in the marital estate?

The marital or relationship asset pool includes all the assets, liabilities and financial resources held by either party – again, regardless of whose name they’re in. This can be broad and often surprising in scope.

Your property settlement may include:

- Real estate – such as your home or investment property, and vacant land

- Superannuation – including self-managed super funds and industry funds

- Cash and savings – such as joint and individual bank accounts

- Vehicles – cars, caravans, boats and motorbikes

- Business interests – such as interests in companies, partnerships or sole trader operations

- Trusts – including interests in discretionary or family trusts

- Shares and investments – including managed funds, share portfolios and crypto assets

- Personal items – such as furniture, jewellery and household contents

- Inheritances and gifts – those received during the relationship, even if in one person’s name only, including lottery wins

- Loans and debts – including mortgages, personal loans, tax or stamp duty obligations and credit card debts

- Insurance and compensation payouts – such as insurance policy payouts

- Overseas assets – including real property, cash or investments

- Pets and animals

It’s important to understand that even assets acquired before or after the relationship may still be included in the marital estate. Our team can help you identify and value all your property to make sure there’s a fair distribution.

Disclosure obligations

Both parties have an obligation under the Family Law Act to provide each other with ‘full and frank’ disclosure. This means that you must give your ex a full accounting of all your property – assets and debts. You’re also required to make sure that those disclosures stay up to date until your settlement has been negotiated and finalised.

You must also be sure that you’re making a full and proper disclosure – including proper valuations – at all times. Complete disclosure is not only required under the Family Law Act. It’s also the only way to determine the accuracy of the values contained in the net asset pool.

If you don’t make a full and frank disclosure, the court has the power to make costs order against you, or even set any orders aside, including final orders. In addition, if you go to the court for consent orders, they won’t make them if they don’t believe you or your ex have made a full disclosure.

If you believe that your former partner hasn’t complied with their duty to provide full disclosure, then if there are court proceedings, you can ask the court to issue a subpoena to have the organisation or company with access to the documents produce them. Or you could request the court make orders requiring the missing or insufficient disclosure.

How does property settlement work in NSW?

Under Family Law, there’s no automatic 50/50 split. Instead, the Family Law Act sets out a four-step process:

- First, identify and value the existing asset pool

- Second, assess the contributions, both financial and non-financial and direct and indirect contributions, as well as parenting

- Third, evaluate the current and future circumstances of each party by looking at factors like income, care of children and health concerns

- Fourth, determine a just and equitable division, including, throughout the process, whether any orders changing ownership, should be made at all.

How to value property

If you and your ex can’t agree on the value of a particular asset, then that asset will need to be valued. Our expert family lawyers can work with you to identify and value your property pool accurately and, most importantly, fairly. We can arrange external valuers and forensic accounts if needed as well.

Methods of reaching settlement

This process of property settlement can be managed through negotiation, dispute resolution such as mediation or court proceedings, if needed. Our Sydney family lawyers can help you navigate every pathway.

- Negotiation – ideal for amicable separations with open communication, or between expert lawyers

- Mediation – a neutral third-party helps you reach a fair agreement

- Arbitration – a privately appointed expertmakes a binding decision

- Collaborative law – both parties work with legal and financial professionals to agree without going to court

- Litigation – if an agreement can’t be reached, we can represent you in court

Once you reach an agreement with your ex, it should be finalised via consent orders or a financial agreement (BFA). A consent order is issued by the court and formalises the agreement that you’ve made about your property settlement. A BFA, is a private agreement between you and your ex, that also formalises your agreement.

We can help guide you as to the right option for your situation, and work with you to make sure your agreements are binding.

How to protect your legal interests

When it comes to property settlement in New South Wales, protecting your legal rights starts with knowing where you stand. Even in seemingly amicable separations, it’s important to take steps to make sure that your financial future is secure.

Here’s how to protect yourself during the property settlement process:

Get legal advice early

Before making any agreements – whether formal or informal – speak to one of our family law experts. Getting early advice will help you prevent costly mistakes, and make sure that you understand what you’re entitled and are in a position to get it.

Document everything

Keep records of financial contributions, loans, gifts, inheritances and business dealings. These documents will help make sure you’re meeting your disclosure obligations – and make sure that there’s transparency and also ensure your contributions are recognized in the settlement. You’ll also feel confident that everything is being accounted for by your ex too.

Be alert to financial red flags

If you suspect your ex isn’t being forthcoming about assets or might even be hiding or transferring them out of reach, be sure to act quickly. We can help you apply for a court order to prevent the disposal of those assets or arrange urgent protections if needed.

Why choose Watts McCray?

At Watts McCray, we’re a team of award-winning property settlement lawyers – including Accredited Specialists in Family Law – who have been helping clients across greater Sydney for over 40 years. We have a proven track record of success stories and five-star client reviews and work diligently to help our clients protect their rights and property.

We offer specialised legal advice, guidance and support regarding asset division and other difficult and complex legal situations. With our team you always have access to a family law specialist to discuss any questions or concerns you have regarding your property settlement. We aim to help you understand and feel more in control of your property division while also providing you with a caring and supportive environment.

Our family lawyers are well placed to provide you with the best possible representation in property settlement and asset division.

Get in touch with one of our expert team today

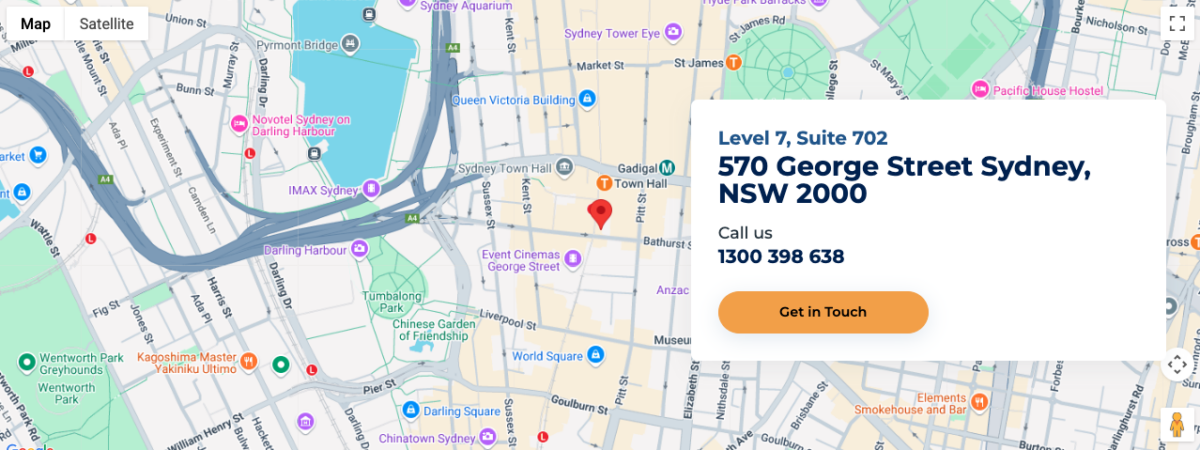

Where you’ll find us in Sydney

Our office sits in the heart of the Sydney CBD, just a one-minute walk from Town Hall Station and the Light Rail stop, a five-minute walk from Museum Station and close to major bus routes on Elizabeth and Liverpool Streets. There are also secure parking stations nearby.

Watts McCray Family Lawyers Sydney

Level 7, Suite 702

570 George Street, Sydney NSW 2000

Contact details

Phone: 1300 398 638

Contact our Specialist Family Law Team

You can contact our divorce lawyers to assist you with the divorce process.

FAQs

The first step is to get in touch with our team. We can give you advice on the agreement reached and the best way to finalise it in your specific situation.

In general, most separated couples who have agreed on how to divide their property can simply apply to the court for a consent order. This is then made without you, your ex or your lawyers having to attend court. However, once orders are made they are enforceable and difficult to change, which is why it’s always advisable to seek professional legal advice first.

A divorce order simply ends your marriage but does nothing else in relation to arrangements for your assets. A property settlement is the process of dividing the property pool (all the assets and liabilities that are part of your relationship) when a relationship ends. It’s this part of the process that effectively disentangles you financially from your ex-partner.

If one partner attempts to, or does, dispose of assets that should form part of the property pool then this will affect the outcome of the property settlement. If you have evidence or even suspect that your ex-partner is attempting to dispose of or hide their assets rather than putting them into the property pool, get in touch with our team straight away.

You can apply for an injunction which will prevent your ex from disposing of property, cash, businesses or other assets. But it’s not always easy to get as the process requires that you demonstrate a real risk of the disposla taking place, and a risk of impact on the overall property settlement. We can help you apply for an injunction to protect your rights and your property.

Yes. Your property pool should include any assets owned – or debts incurred – outside of Australia. This is required as part of full and frank disclosure.

Direct financial contributions are those that you or your partner have made directly into the property pool. For example, this could be towards buying the family home, renovating the home, buying a car or the income you’ve earned.

Indirect financial contributions are financial contributions that are made toward the acquisition, improvement or maintenance of marital property but that aren’t made by you. So, for example, if your parents gave you money to fix the roof on your home, that contribution forms part of the property pool as an indirect contribution.

The court considers non-financial contributions to be part of the property pool, so not working does not automatically mean you are not entitled to a property settlement. If you spent time raising children, managing and taking care of the home and other property, gardening, decoration, cleaning and other maintenance, then these are contributions that will be considered.

Contact our Specialist Family Law Team

Do you have a question about family law or relationship law?

Contact us today, and a member of our team will get back to you soon.

Meet our Lawyers

Other Family Law Services

Accredited to deliver

Choose a team with more accredited lawyers.