Anytime you’re entering into a new relationship, getting married or even rebuilding after divorce, it’s a great time to think about your financial situation… and how to protect it. When you’re going through a relationship change, uncertainty around finances can weigh heavily on you – especially if you’ve worked hard to build your wealth or want to protect your family’s future.

That’s where a binding financial agreement (or BFA) can help.

What is a binding financial agreement?

Sometimes known as a prenuptial agreement or prenup, a BFA is an agreement that a couple makes that documents how you want your property interests to be divided in the event that their relationship ends. Despite all these agreements often being collectively called a ‘prenup’, a BFA can in fact be entered into at any time – before, during or even after a relationship. It can also cover spousal maintenance.

Your BFA can cover:

- Real estate and property

- Superannuation

- Inheritances and gifts

- Business assets and liabilities

- Loans, mortgages and credit card debt

- Future earnings or savings

Benefits of having a prenuptial agreement

Having a prenuptial agreement of binding financial agreement in NSW gives you and your partner peace of mind, because you’ve already agreed on what outcome you want, if for any reason your relationship doesn’t continue. That means there’s no uncertainty if things change.

Other key benefits are that it can protect your existing assets, clarify financial expectations, reduce conflict and stress if you do end ups separating and help you avoid costly court proceedings while also saving time and legal fees in property settlement.

It’s helpful to remember that entering into a BFA doesn’t mean that your marriage is doomed or that you and your partner aren’t fully committed. Rather, it gives both parties peace of mind if the marriage comes to an end, knowing that their assets and family are fully protected. We also have many clients saying that it encourages good communication in relation to finances, from the outset.

Who needs a binding financial agreement?

Despite these benefits, many people still think that binding financial agreements are only for the wealthy. The truth is that everyday Australians are increasingly using them because peace of mind is a benefit for everyone.

You might benefit from a BFA if:

- You’re entering into a marriage or de facto relationship

- You have existing assets, like property, savings or super

- You own a family business or expect to receive an inheritance

- It’s a second marriage and you want to protect your children’s future

- You want to avoid court disputes in the event of a relationship breakdown

How we help

At Watts McCray, our Sydney-based family lawyers can help guide you through the BFA process so that you can have this confidence and security as well. Our team are family law accredited specialists with years of experience. This experience coupled with sound knowledge of the BFA or pre-nup process ensures favorable, stress-free outcomes for our clients.

Whether you’re planning a wedding, entering into a second marriage, protecting family assets or simply want to define the financial responsibilities clearly, our family law specialists can help you put the right agreement in place.

Why choose Watts McCray Sydney lawyers?

Our Sydney clients choose Watts McCray when they’re considering having a BFA created, or need one reviewed because they trust us to make sure their rights are protected. They also choose us because:

- We have number of accredited specialists in family law

- We’ve helped thousands of clients achieve successful outcomes

- We take the time to listen, explain and simplify the legal process

- We approach every matter with respect, clarity and empathy to support you and to ensure the agreement meets your specific needs.

Our legal team has extensive knowledge of family law. We can discuss any potential issues to help ensure your agreement has all the legal requirements needed to protect your assets properly. You can feel confident that you’re prepared for about the future in regard to your property, in the event of any future separation.

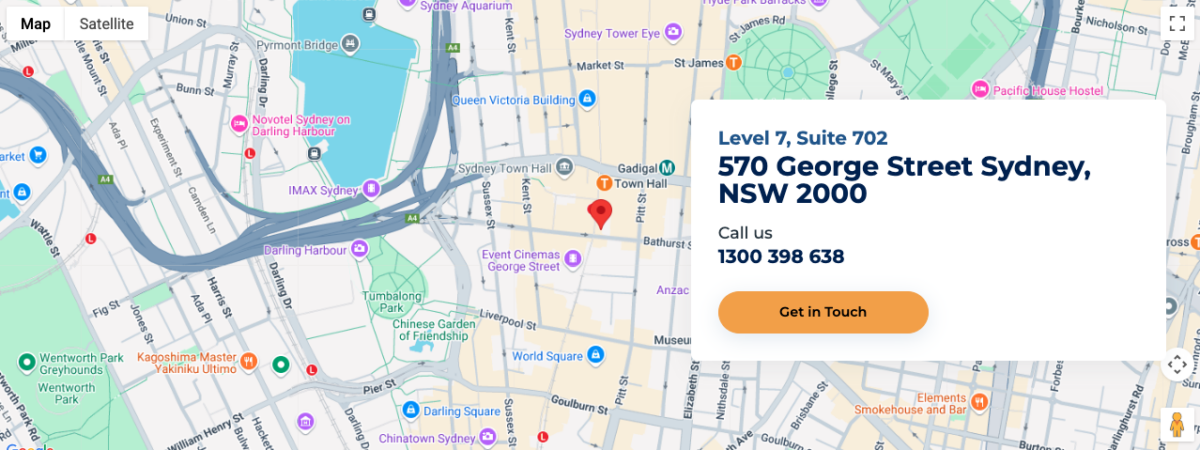

Where you’ll find us in Sydney

Our office sits in the heart of the Sydney CBD, just a one-minute walk from Town Hall Station, a five-minute walk from Museum Station and close to major bus routes on Elizabeth and Liverpool Streets. There are also secure parking stations nearby.

Watts McCray Family Lawyers Sydney

Level 7, Suite 702

570 George Street, Sydney NSW 2000

Contact details

Phone: 1300 516 443

FAQs

Property settlements can take years to be finalised. And they can cost a significant amount, if there’s no binding financial agreement in place.

On the other hand, if you have a BFA in place, it will save you time and money, as well as stress and conflict if your relationship does end. And it gives you and your partner confidence that your property will be handled according to your wishes. In fact, both parties will have certainty of outcome should the relationship come to an end.

In Australia, the cost of a binding financial agreement will vary. Drafting up documentation and advice during the process, and executing the financial agreement are all key factors that contribute to the overall cost of the agreement. However, if you and your partner have agreed as to how your property should be handled, the cost of obtaining a financial agreement can be kept relatively low.

Any BFA, once entered into, will not expire under Australian law, unless an explicit end date is included. It will remain in effect until it is terminated or amended by the parties. It is important to remember that if you do have a BFA in place, and you separate, you must abide by its terms or you could still end up in legal proceedings.

Contact our Specialist Family Law Team

Do you have a question about family law or relationship law?

Contact us today, and a member of our team will get back to you soon.

Meet our Lawyers

Other Family Law Services

Accredited to deliver

Choose a team with more accredited lawyers.

Contact our Specialist Family Law Team

You can contact our divorce lawyers to assist you with the divorce process.